20+ Fha loan eligibility

This includes the current FHA guidelines related to income debt-to-income ratios and employment. However its possible to get an FHA loan with a bad or.

1

These funds must come exclusively from FHA.

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

. Youll need to make a down payment of 35 if your credit score is 580 or higher. Types of Properties You Can Finance with a FHA Loan. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Fannie Mae HomePath. For borrowers interested in buying a home with an FHA loan with the low down payment amount of 35 applicants must have a minimum FICO score of 580 to qualify. If youre applying for any kind of mortgage including FHA its a good idea to have at least two or three accounts open and reporting on your credit whether those are revolving accounts like credit cards or monthly loan payments to a personal loan.

You just need to have a minimum down payment. Conventional loans usually require a 20 down payment. Are considered and used to make decisions regarding eligibility and terms for a loan.

We offer no obligation mortgage consultations and quotes visit this page to request a free consultation. Additionally the lender checks the financial history of the person getting the. FHA loans require 085 of the loan amount per year for most borrowers but Home Possible borrowers could qualify for PMI as low as 05 depending on credit scores and the LTV ratio.

The 9 requirements for an FHA loan in 2022. FHA expands mortgage eligibility for borrowers affected by COVID-19. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at 620.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Eligibility now includes National Guard members with at least 90 days of active service including at least 30 consecutive days under Title 32 Sections 316 502 503 504 or 505. FHA loans are available for many different types of properties.

HUD determines the FHA ceiling loan amount by using an initial loan amount and the ceiling amount. To apply for an FHA loan you must find an FHA-approved lender which may include banks credit unions and online lenders. FHA Loan Income Requirements Debt Guidelines You may be curious how much income is needed to qualify for an FHA loan.

Mortgage loan basics Basic concepts and legal regulation. Homeowner Tax Deductions. He was a programming consultant for radio and TV stations in some 20 markets.

FHA loans have a 500 minimum median qualifying credit score. Your Guide To 2015 US. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

You may still qualify for an FHA loan if your DTI is high compared to your income particularly if your credit score is higher. If your credit score is below 580 however you. Rocket Mortgage requires a minimum 580 credit score to qualify.

FHA loan requirements and guidelines for mortgage insurance lending limits debt to income ratios credit issues and closing costs. For instance an FHA loan with a 15-year term would have much higher payments than one with the same loan amount and a 30-year term Make sure all your loan offers are quoting the same loan type. The exception is if you already have your loan with us and.

Would you assistance determining property eligibility or get pre-approved for a FHA loan. This page covers the FHA loan income requirements for 2022. Before sharing sensitive information make sure youre on a federal government site.

Since the year 2000 FHA loan rates were usually 0125 to 025 higher than conventional loans. An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA. The following list includes items that can negatively affect your loan eligibility.

For those interested in applying for an FHA loan applicants are now required to have a minimum FICO score of 580 to qualify for the low down payment advantage which is currently at around 35 percent. Unlike VA loans where the lender provides the funds the VA is the lender for the NADL home loan program. FHA loans require a minimum FICO score of 580 to qualify for 35 down or 500 for 10 down.

The gov means its official. Federal government websites often end in gov or mil. An FHA insured loan is a US Federal Housing Administration mortgage insurance backed.

Updated March 2 2022. 647200X 65 420680 FHA 2022 Floor Loan Amount. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018.

But except for the years following the late 2000s financial crisis 2010 2015 for a couple of years FHA loan rates were lower than conventional mortgages. You can still get an FHA loan if youve got a credit score in the 500 - 579 range but youll need to come up with a 10 down payment. How To Choose the Right Location for a Home.

Your length of service or service commitment duty status and character of service determine your eligibility for specific home loan benefits. However having a credit score thats lower than 580 doesnt necessarily exclude you from FHA loan eligibility. Anchor Loan Amount.

This is the highest amount that any MSA can have as their Maximum FHA Loan amount for 2022 except for high-cost areas. And you must have a valid Certificate of Eligibility. FHA Loans For Bad Credit Or No Credit History.

Calculate 2022 FHA Ceiling Loan Amount. FHA loans actually do not have a minimum income requirement nor are. FHA lenders are limited to charging no more than 3 to 5 percent of the loan amount in closing costs and the FHA allows up to 6 percent of the borrowers closing costs such as fees for an.

FHA loans are designed for low-to. FHA loan calculator including current FHA mortgage insurance rates taxes insurance HOA dues and more. No Credit History.

So if your purchase price exceeds FHAs limit you might want to save up 5 and try for a conventional loan instead. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. However most FHA-approved lenders set their own credit limits.

The Housing and Civil Enforcement Section of the Civil Rights Division is responsible for the Departments enforcement of the Fair Housing Act FHA along with the Equal Credit Opportunity Act the Servicemembers Civil Relief Act SCRA the land use provisions of the Religious Land Use and Institutionalized Persons Act RLUIPA and Title II. Discover your FHA home buying eligibility. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

Plus conventional loan limits are higher than FHA loan limits. Even better PMI can be removed from a Home Possible loan entirely once the LTV ratio drops below 80 meaning at least 20 of the property value has been repaid.

How Does An Fha Loan Work

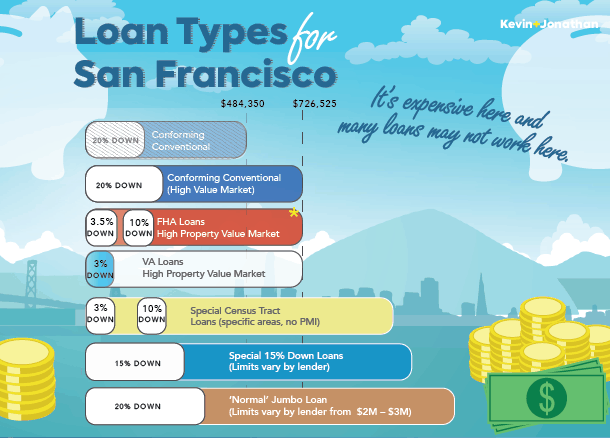

Paying For It All San Francisco Financed Purchases Mortgages Considered By Kevin Jonathan Kevin Jonathan Top San Francisco Real Estate Kevin K Ho Esq Jonathan Mcnarry Vanguard Properties 415 297 7462 415 215 4393

How Do I Qualify For A Fha Loan With A Low Credit Score

Fha Reverse Mortgage Wisconsin Illinois Minnesota And Florida

/GettyImages-12509704032-e2ec2e8bfaa7431aab1026594e03e974.png)

How Does An Fha Loan Work

Can I Get An Fha Loan With Late Payments On My Record Youtube

2

What Is An Fha Appraisal Helpful Checklist Home Appraisal Fha Inspection Fha

Fha Mortgage Loans Mortgage Network Solutions Llc

1

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

How Does An Fha Loan Work

1

1

Fha Removes 1 Rule To Qualify For A Mortgage With Student Loans Find My Way Home

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

How Does An Fha Loan Work

6 Reasons To Avoid Private Mortgage Insurance

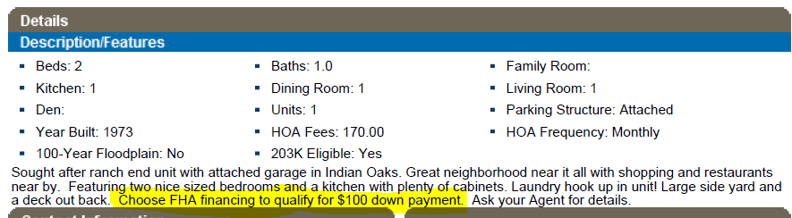

Fha 100 Down Program